property tax assistance program nj

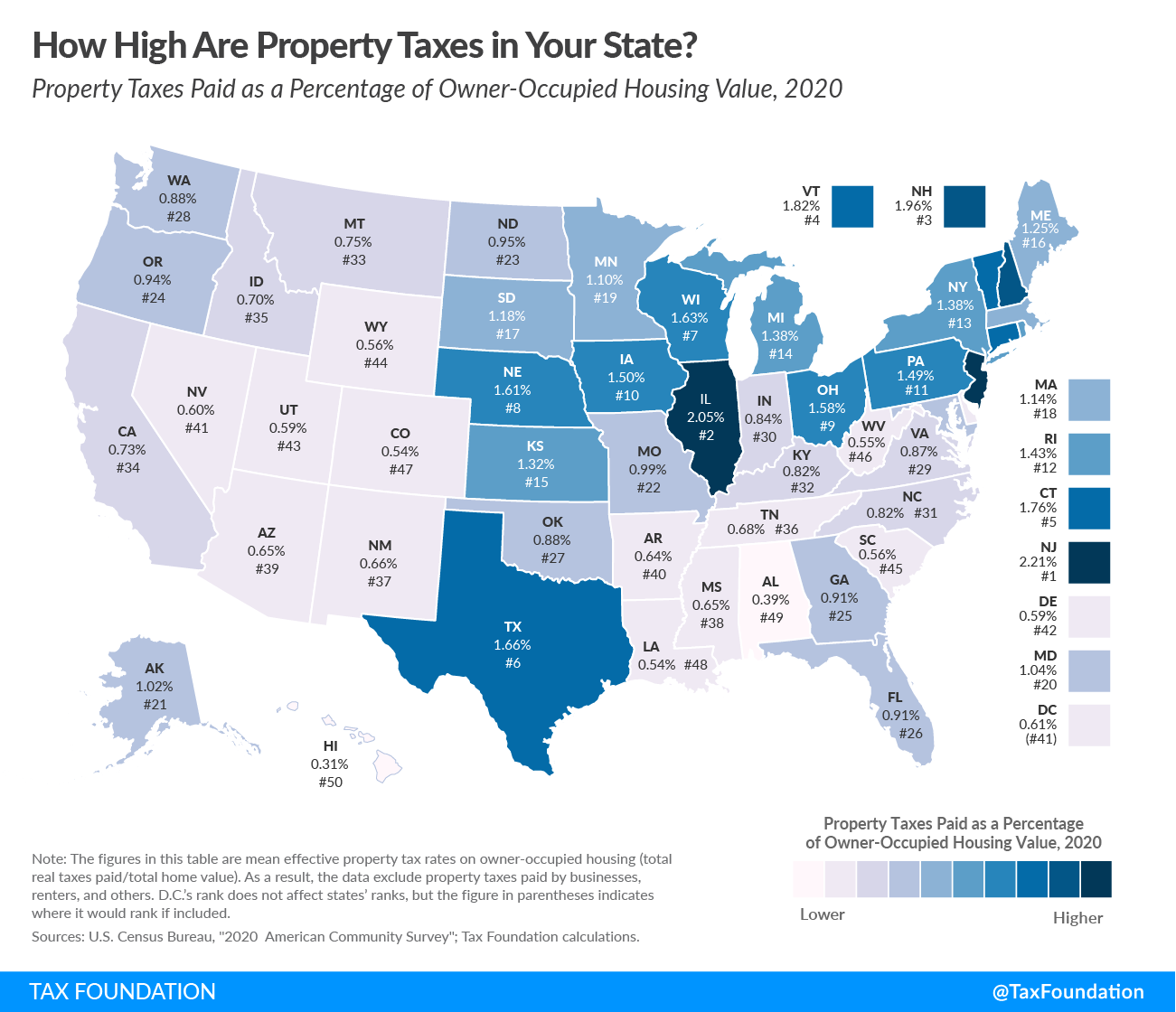

We in New Jersey have one of the highest property taxes in the nation. The Affordable New Jersey Communities.

The Ten Lowest Property Tax Towns In Nj

Estimated Tax on Income From.

. Of course the homeowner must have been delinquent on paying their property taxes. The state of New Jersey is offering a new property tax relief program that is replacing the previous Homestead Benefit program. Ad Real Estate Tax Liens Yield 18-36 Interest Or Possible Ownership.

To 530 pm except State holidays. Office hours are Monday through Friday 830 am. Your total annual income combined if you were married or in a civil union and lived in the same home was.

At New Jersey Tax Assitance we help New Jersey residents who are behind on their New Jersey property taxes. Tax Lien Certificates Yield Great Returns Possible Home Ownership. 1-888-238-1233 or 1-877-658-2972 NJ Property.

2021 94178 or less. Eligible seniors retirees as well as disabled residents will receive reimbursement for. Stay up to date on vaccine information.

Ad See If You Qualify For IRS Fresh Start Program. 100s of Top Rated Local Professionals Waiting to Help You Today. Long-awaited help is coming for homeowners who have fallen behind on their mortgages property taxes and other expenses.

Senior Freeze Property Tax Relief Receive property tax assistance from the Senior Freeze program. New Jersey Gov. Department of the Treasury Division of Taxation PO Box 281 Trenton NJ 08695-0281.

You also may qualify if you are. Helping New Jersey Families. Homeowners making up to 250000 per year may.

The state has two programs that are supposed to help seniors with the costs. Senior Freeze Property Tax Reimbursement. 112 Pennsylvania Residents Working in New JerseyNew Jersey Residents Working in Pennsylvania.

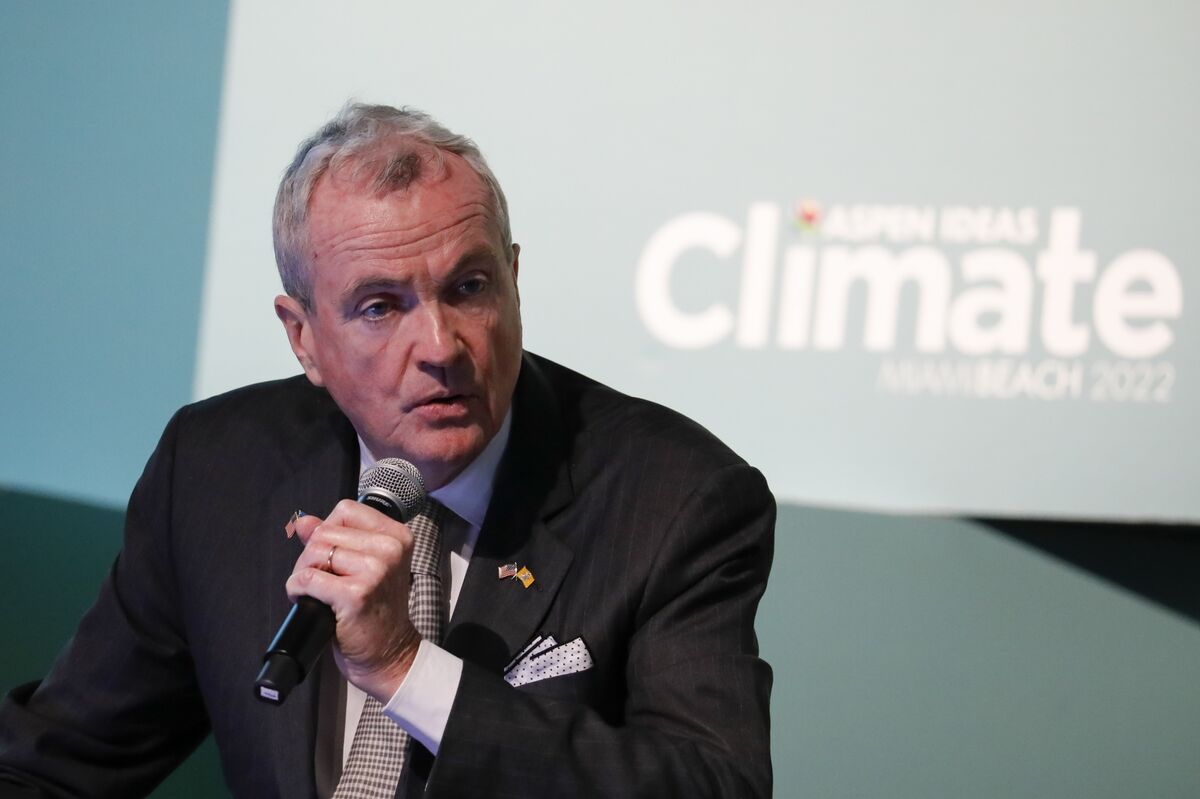

The filing deadline for the 2018 Homestead Benefit was November 30 2021. Senior Freeze - Property Tax Reimbursement Ph. Phil Murphy and his fellow Democrats who lead the.

Phil Murphy has unveiled a property tax relief plan for nearly 18 million state residents for fiscal year 2023. We Help Taxpayers Get Relief From IRS Back Taxes. Homestead Benefit Program.

We Help Taxpayers Get Relief From IRS Back Taxes. The applicant will need to be the owner of the real estate property according to the assessors records. About two million New Jersey homeowners and renters would get larger property tax rebates than originally planned as Gov.

The New Jersey Homestead Benefit Program provides property tax relief to eligible homeowners in the form of a property tax credit that the state pays to municipalities on. State Property Tax Relief Programs. The Emergency Rescue Mortgage.

For most homeowners the benefit is distributed to your. Property Tax Relief Programs. COVID-19 is still active.

Covid19njgov Call NJPIES Call Center for medical information related to COVID. 2020 92969 or less. The Homestead Benefit program provides property tax relief to eligible homeowners.

Get program information from a Division representative. We do not help businesses and we do not offer. Ad See If You Qualify For IRS Fresh Start Program.

1-800-882-6597 NJ Homestead Rebate Program Ph. New Jersey homeowners struggling to pay their mortgage or property taxes can apply for up to 35000 in aid when the state opens its application portal on Feb. Free Case Review Begin Online.

You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes. This program provides property tax relief to New Jersey residents who owned or rented their principal residence main home on October 1 2019 and met the income limits. The Property Tax Reimbursement.

Ad Apply For Tax Forgiveness and get help through the process. If you are age 65 or older or disabled and have been a New Jersey resident for at least one year you may be eligible for an annual 250 property tax deduction. Free Case Review Begin Online.

Property Taxes Property Tax Analysis Tax Foundation

Property Tax Appeal Tips To Reduce Your Property Tax Bill

Cypress Texas Property Taxes What You Need To Know Property Tax Tax Attorney Tax Lawyer

Gov Phil Murphy Announces Expansion Of Anchor Property Tax Relief In New Jersey Cbs New York

Property Taxes In Nevada Guinn Center For Policy Priorities

Property Taxes Property Tax Analysis Tax Foundation

Pennsylvania Property Tax H R Block

Deducting Property Taxes H R Block

/gettyimages-1299026418-1024x1024-53a7a37a410d4c749c0060f7bcc7f813.jpeg)

Real Estate Taxes Vs Personal Property Taxes

Nj Property Tax Relief Program Updates Access Wealth

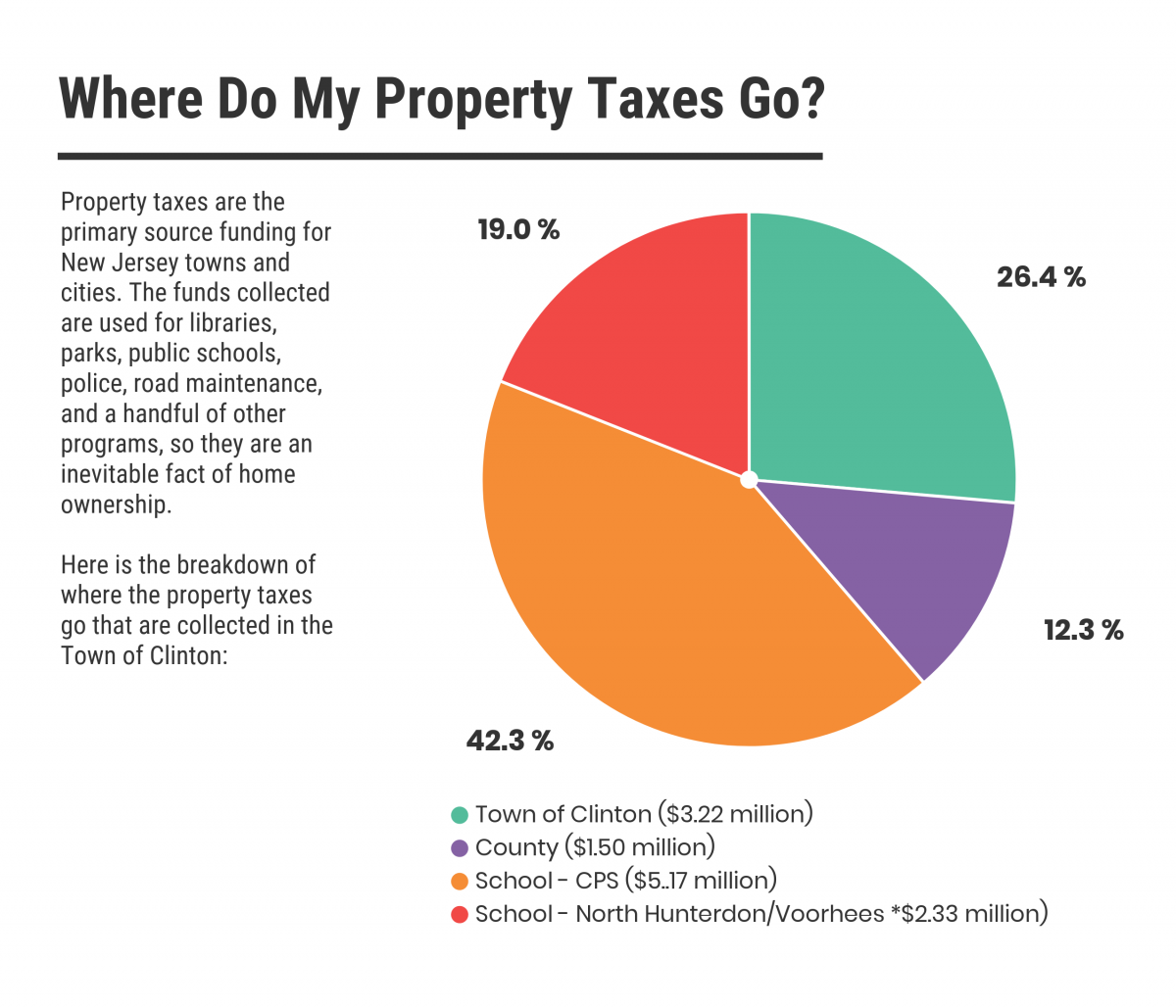

Where Do My Taxes Go Clinton Nj

Property Taxes By State Embrace Higher Property Taxes

Which States Do Not Have Property Taxes In 2022 Ny Rent Own Sell

The Official Website Of City Of Union City Nj Tax Department

New Jersey To More Than Double Property Tax Relief To 2 Billion Bloomberg

What You Need To Know About Condo Property Tax

Anchor Property Tax Relief Program Instructions Are In The Mail New Jersey Business Magazine

N J Now Has 2b In Property Tax Relief What You Need To Know And How To Get Your Rebates Nj Com